Organize your fund’s valuation process with a dedicated

portfolio valuation solution.

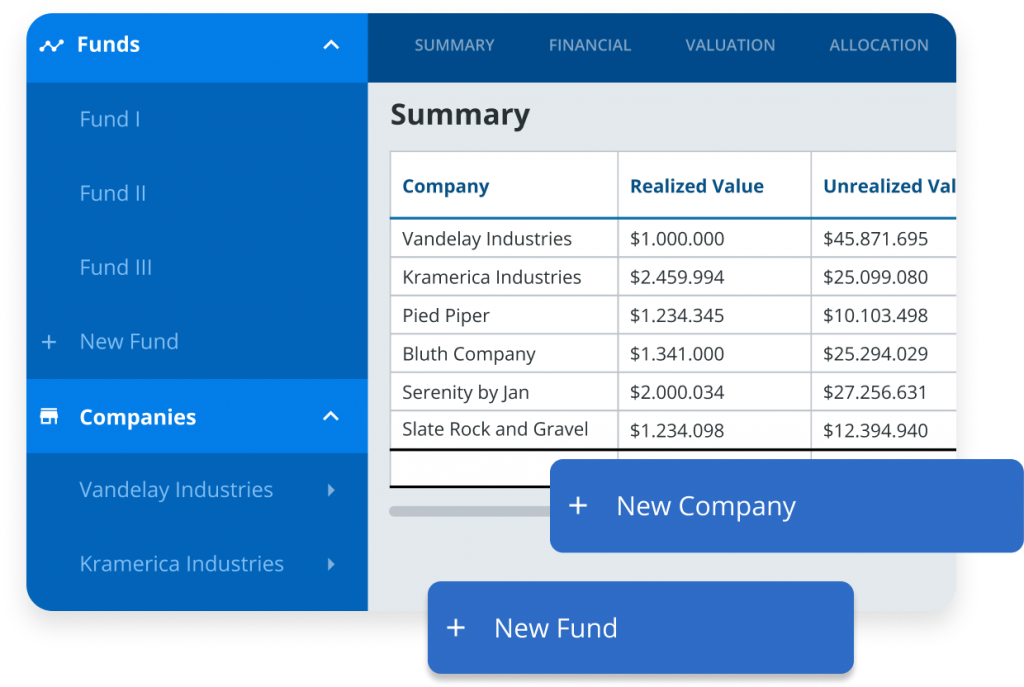

Unlimited Funds and Companies

Small or large portfolios can be managed in a centralized location with reporting at each level, company, fund, and firm.

Scalar’s services can easily augment internal teams in order to easily scale the management of the entire fund.

Auditors can find key information at a glance for each valuation.

Portfolio valuation software provides flexibility to handle each company’s individual facts and circumstances.

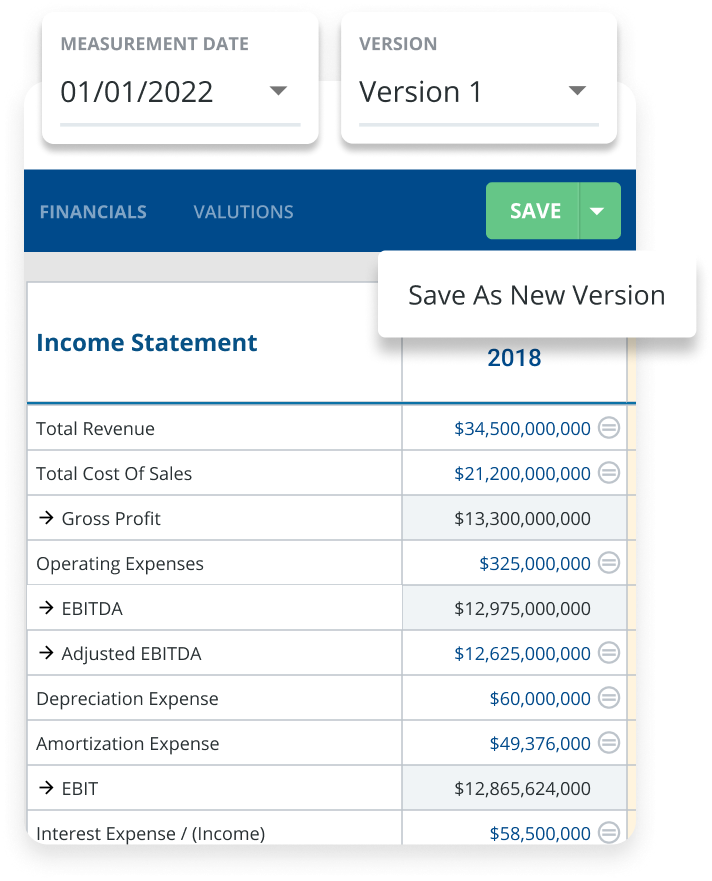

Easy Rollover of Valuations and

Financials to New Quarters

It is quick to rollover the previous period’s valuations. Making new reporting easier for each new quarter, as only new events or financials need to be updated.

Centralized access to all historical valuations

Instead of a folder of full of excel and PDF files, now it can be simple to browse all your historical valuations for your entire fund and track the growth over time.

Reporting is updated instantly with any changes to valuations or allocations

Always have access to an up-to-date IRR and MOIC for all of the portfolio’s investments.

Multiple versions can be created

Versioning your valuations allows for a full history at any point in time or when initial drafts want to be kept for record keeping purposes.

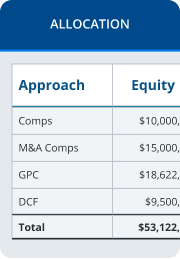

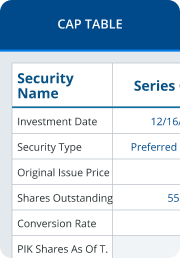

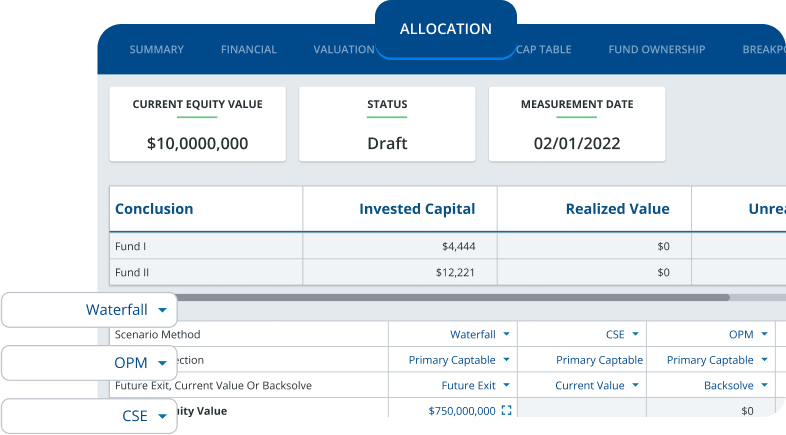

Create and weight multiple valuation and allocation approaches, capture custom waterfall economics, and convert foreign currencies

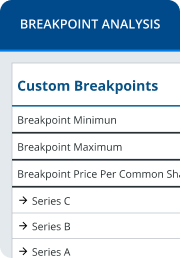

Instant Waterfall Calculations

The detailed economics of the waterfall distribution based on any valuations are available for every company valuation. Additionally, the waterfall can be displayed for any equity value desired in order to quickly calculate that distribution for any specified cap table.

| Exit Equity Value | |

| Cap Table | Primary |

| Security | Distribution | Per Share |

|---|---|---|

| {{value.security.name}} | $ {{localeString({value: value.value, digits: 0})}} | $ {{localeString({value: allocation.present_values[index].value})}} |

| Total | $ {{localeString({value: allocation_sum, digits: 0})}} |

Convert Foreign Currencies

Foreign currencies are supported for funds or companies and any data can be viewed and converted to any other currency. In addition, the number format can help match the reports and data to the format desired.

| Income Statement | 2019 | 2020 |

|---|---|---|

| {{transformed_text(item.value)}} | {{transformed_text(item.value)}} |

Multiple Valuation Approaches

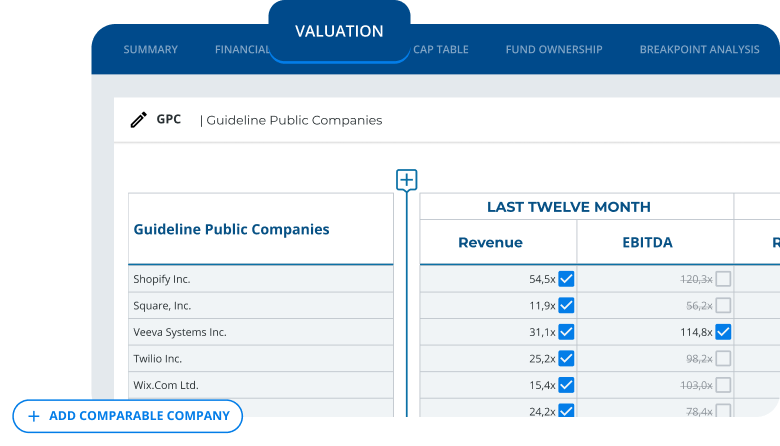

Public Comps

Include any public company with any reporting date, use revenue or EBITDA multiples for actual and projected financials. The multiple can be updated as often as needed.

LEARN MORE

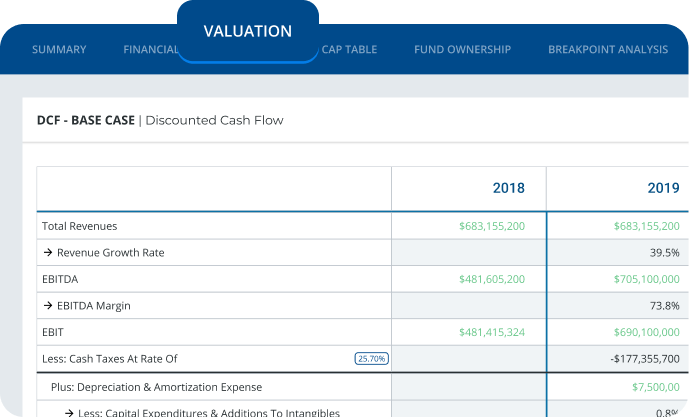

DCF

Advanced DCF valuations allow robust cash flow calculations.

LEARN MORE

Future Exit

Project a future exit and a present value will be automatically calculated based on provided parameters.

Backsolve

Backsolve to a single equity value or use an entire basket of equity values.

Flexible Allocation scenarios

Meet the Scalar Technology Team

Frequently Asked Questions

Who creates the valuation opinions for each company?

Scalar offers full-service valuation services that can be purchased for a portion or all of the portfolio companies, or a fund admin can use the self-service tools to create the valuations using the variety of valuation approaches and allocation methods that are available in the application.

What export formats are available for a report?

Instead of a folder of full of excel and PDF files, now it can be simple to browse all of your historical valuations for your entire fund and track the growth over time. The software is meant to be used entirely online without the need to use separate offline files. With the advanced user permission system you can give an auditor direct access to the software so they can view the firm or fund summary and all of the supporting details of each company’s valuation. Excel export tools are provided in the software for any offline access to the data is needed or additional outside data manipulation is required.

Is Scalar and the software SOC 2 compliant?

Yes, Scalar Technology has a completed SOC 2 Type II audit report. To request a copy of the report contact your account manager or fill out our confidential report access request and let us know that you are needing a copy of this report. Additionally, more information about all of the security controls we actively monitor using automated tools can be viewed on our 3rd party audited Security Report.

What pricing is available for NVCA members?

Scalar + NVCA | Special portfolio valuation offers exist for NVCA members, contact us for more details.

How do I get started?

Simply fill out the form or contact us directly via phone or chat and a representative will set up your account, provide an initial demo, and discuss pricing options. Scalar’s 14+ years of experience mean that any possible situation can be accommodated and we will have the experience necessary to help build a software and services package that meets any situation.