Overview

When buyers and sellers are negotiating a transaction, one of the key decisions for a buyer to make is whether to purchase a group of the target’s assets or its actual business. This decision will impact the buyer’s accounting treatment of the transaction and its respective financial statements.

When buyers and sellers are negotiating a transaction, one of the key Financial Accounting Standard Board’s (“FASB”) Accounting Standards Codification Topic 805, (“ASC 805”), Business Combinations provides an entity with the criteria to evaluate whether a transaction will meet the definition of an asset acquisition versus a business combination and outlines the appropriate guidance to account for the transaction. Furthermore, ASC 805, provides valuation professionals with a framework to identify and to value the net assets acquired based on whether the transaction qualifies as an asset acquisition1 or a business combination.

Determining if a transaction qualifies as an Asset Acquisition versus a Business Combination

Asset Acquisition

The term “asset acquisition” represents an acquisition of an asset, or a group of assets, and the assumption of liabilities that does not meet the U.S. GAAP definition of a business. In January 2017, the FASB issued ASU 2017-01, Clarifying the Definition of a Business, which changed the broader definition of a business as previously outlined under ASC 805. This new ASC 805 guidance was intended to clarify the definition of a business since the previous definition was often too broadly applied and resulted in more entities accounting for transactions as business combinations rather than asset acquisitions. ASC 805-10-55-4 previously defined three key elements inherent in a business that represent an integrated set of activities as follows: inputs, processes, and outputs (collectively referred to as a “set”). Below, we briefly define these three elements2:

Inputs – Economic resources that create, or have the ability to create, outputs when one or more processes are applied to it. Examples include long-lived assets (such as buildings or machinery), intangible assets (such as patents, trademarks, or other intellectual property), the ability to obtain access to necessary material or rights, and employees.

Processes – Systems, standards, protocols, conventions, or rules that when applied to an input or inputs, creates or has the ability to create outputs. Examples include strategic management processes, operational processes, and resource management processes.

Outputs – The result of inputs and processes applied to those inputs that provide or have the ability to provide a return in the form of dividends, lower costs, or other economic benefits directly to investors or other owners, members, or participants.

Under the old ASC 805 guidance, to qualify as a business, a set of activities and assets were required to have only inputs and processes, which together were or would be used to create outputs. Furthermore, the FASB indicated that outputs do not need to be present at the acquisition date for a set of activities and assets to be a business.

The new ASC 805 guidance as described in ASC 805-10-55-5A through 5C, introduces a screen for determining when a set of activities and assets does not constitute a business. FASB requires that an entity first evaluate whether substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. If this screen is met, then the set is not a business.

For a transaction where the screen is met and the set does not represent a business, the acquiring entity will account for the transaction as an asset acquisition and utilize a cost accumulation model in accordance with the guidance under ASC 805-50.

For a transaction where the screen is not met, the FASB requires that an entity evaluate whether the set meets the definition of a business. Under the new ASC 805 guidance, a set is considered a business, if at a minimum, it includes an input and a substantive process that together significantly contribute to the ability to create outputs.

Business Combination

Under ASC 805-10, an entity must determine whether a transaction meets the definition of a business combination, which requires that the net assets acquired meet the definition of a business. ASC 805 defines a business combination as “a transaction or other event in which an acquirer obtains control for one or more businesses. Transactions sometimes referred to as true mergers or mergers of equals also are business combinations.”3

A business combination typically occurs when an acquiring entity purchases the net assets or equity interests of a business in exchange for cash, equity interests of the acquiring entity, or other consideration. We note that a business combination could also occur without the transfer of consideration. If the transaction meets the definition of a business combination and therefore a business, the FASB requires an entity to account for the transaction as a business combination and apply the acquisition method in accordance with the guidance under ASC 805-10.

Summary of Significant Differences between Accounting for an Asset Acquisition and a Business Combination

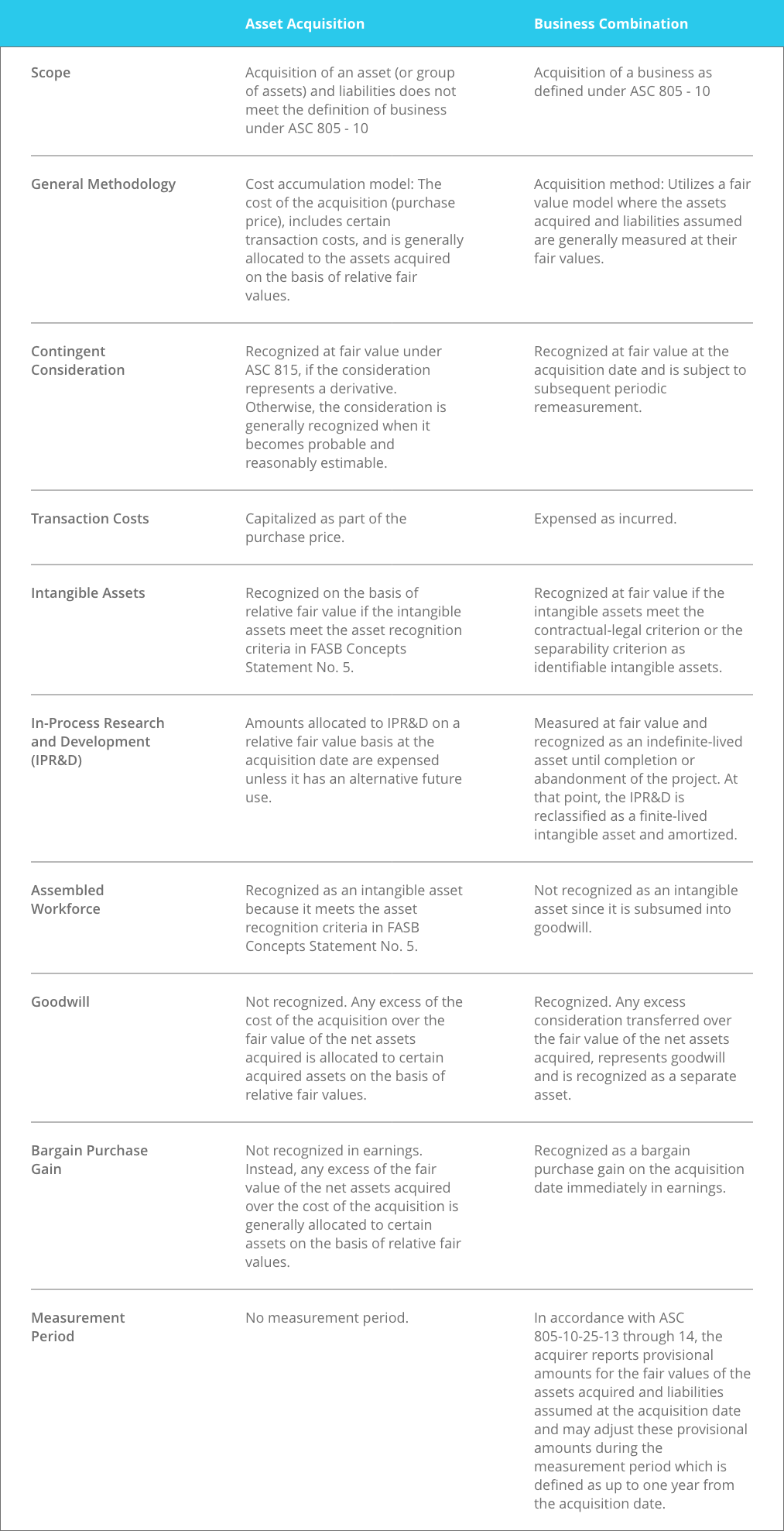

The table below provides a summary of the significant differences between accounting for an asset acquisition and a business combination:

In the sections below, we present examples of how the accounting treatment differs between an asset acquisition and a business combination at the acquisition date.

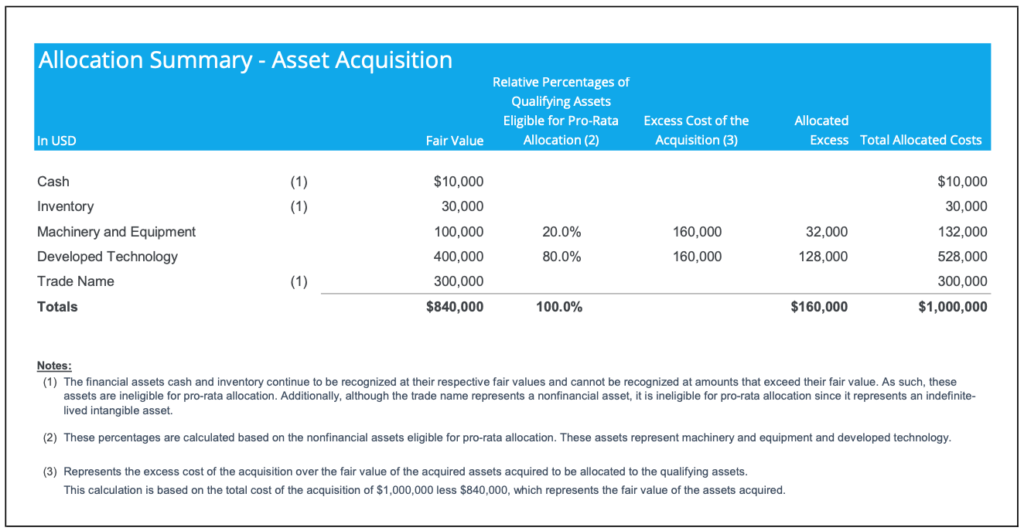

Example of Accounting for an Asset Acquisition

Company ABC (“ABC”) acquires a group of assets from Company XYZ (“XYZ”). These assets include cash with a fair value of $10,000, inventory with a fair value of $30,000, machinery and equipment with a fair value of $100,000, developed technology with a fair value of $400,000, and a trade name that represents an indefinite-lived intangible asset with a fair value of $300,000. The total cost of the acquisition, including transaction costs is $1,000,000. ABC has determined that the assets do not classify as a business and the transaction represents an asset acquisition. As such, ABC allocates the cost at the acquisition date as follows:

Example of Accounting for a Business Combination

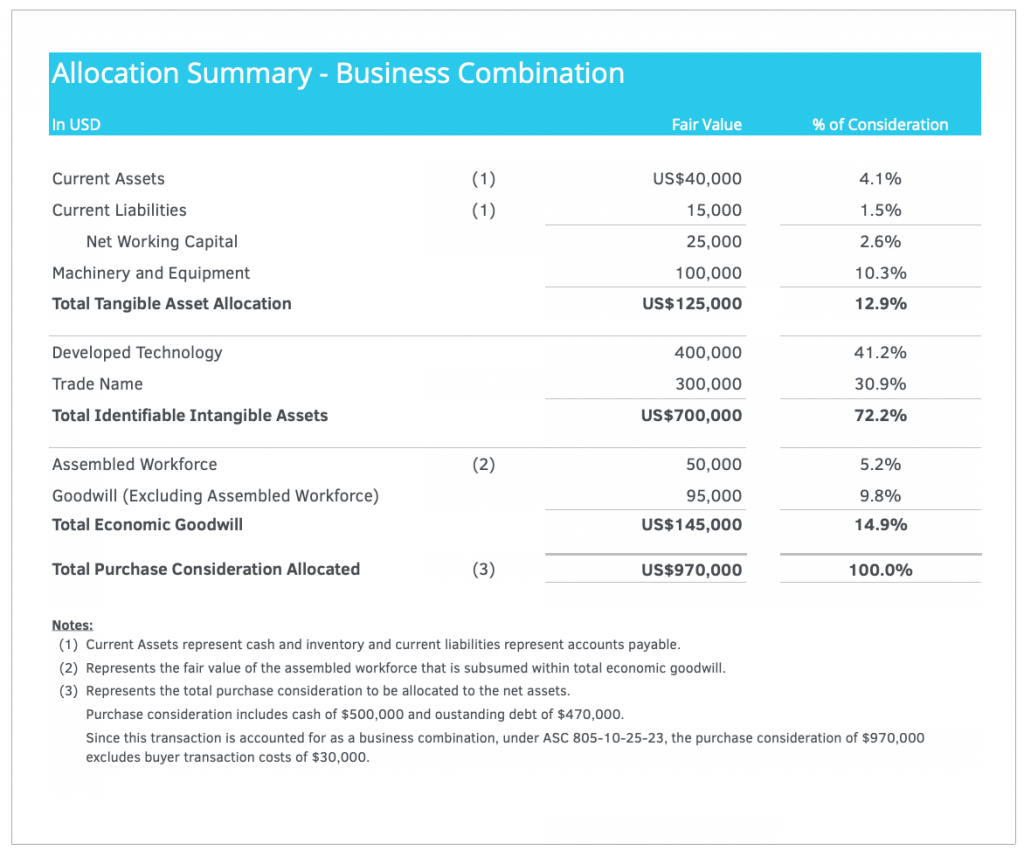

ABC acquires XYZ in a business combination. The total purchase price of $1,000,000 represents $500,000 in cash, $470,000 in outstanding debt, and $30,000 in buyer transaction costs. The assets acquired include cash with a fair value of $10,000, inventory with a fair value of $30,000, machinery and equipment with a fair value of $100,000, developed technology with a fair value of $400,000, a trade name that represents an indefinite-lived intangible asset with a fair value of $300,000, and an assembled workforce with a fair value of $50,000. Additionally, ABC assumed some current liabilities representing accounts payable of $15,000. ABC has determined that the transaction qualifies as a business and allocates the purchase price to the acquired net assets based on the acquisition method as follows:

Conclusion

We hope the examples presented above, assist you as a starting point when you are contemplating a transaction by carefully considering the accounting impacts to your financial statements and any possible tax implications. We suggest conferring with both your auditors and tax advisors before deciding whether to purchase either a group of the target’s assets or its business. After you make this important decision, Scalar is happy to assist you with the next steps of allocating the purchase price paid and valuing the assets acquired and liabilities assumed.

Notes:

- 1 In the case of asset acquisitions, the valuation professional should consider FASB Concepts Statement No. 5, Recognition and Measurement in Financial Statements of Business Enterprises.

- 2 ASC 805-10-55-4

- 3 FASB’s Master Glossary of ASC 805.