Many entrepreneurs and founders are often at a loss when their lawyer or investors advise them to get a 409A valuation. They aren’t sure what a complete 409A valuation entails, why exactly they need one, or how to even start the process. This article answers some of the most basic questions for understanding the Internal Revenue Code (IRC) section 409A.

What is section 409A?

The IRC section 409A requires a company issuing deferred compensation (e.g. stock options) to do so at a fair market value determined through a formal valuation from a third-party service provider. The IRS requires a 409A to set a strike price for common shares (issued to advisors, employees, etc.) to ensure the value is accurate.

Why do you need a 409A valuation?

The IRS has instituted a safe harbor provision which means a formal valuation performed by an independent valuation firm will be accepted as a valid method for determining the fair market value of a company’s common stock. This avoids potential conflicts of interest, provides transparency into the fair market value calculation, and protects your company from a potential IRS audit.

Additionally, employees who receive the deferred compensation benefit may incur a 20% federal income tax penalty and will be taxed on those options immediately in the event the company issues the associated security below its fair market value. Consequently, a company’s management and board of directors need to take precautions to ensure the fair market value is determined accurately.

When do you need to get a 409A valuation?

You should initiate a 409A valuation when preparing to issue your first common stock options. Once an initial valuation has been performed by an independent appraisal firm, regulations require that the valuation opinion is updated every 12 months or any time there is a material change to the business such as fundraises or key hires.

How is the fair market value of your stocks determined?

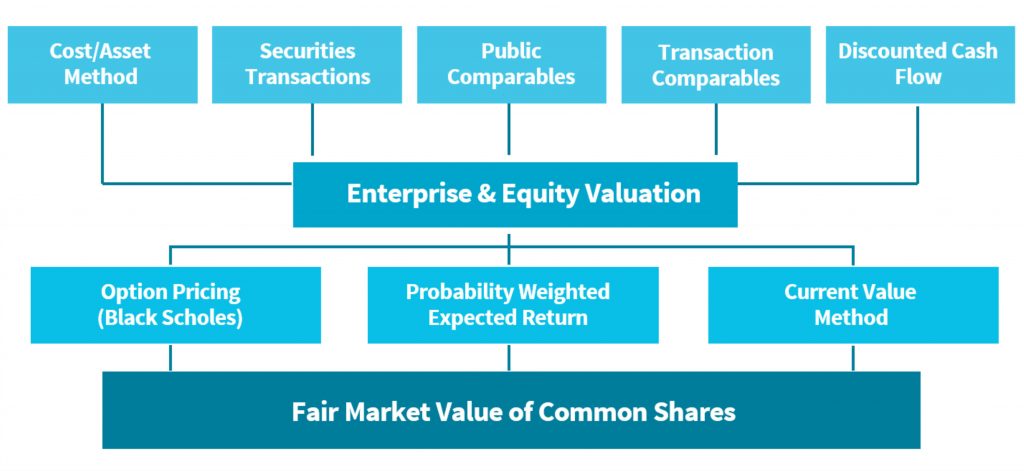

The IRS and the American Institute of Certified Public Accountants (AICPA) have issued guidelines for valuing the common stock of privately held companies. These guidelines suggest that valuation experts use the market, income, and cost approaches to determine the firm’s total equity value.

The market approach is used after your company raises an equity round and uses what investors have paid to set the price. The income approach is used when companies have positive cash flow and satisfactory revenue. The cost approach is used for early-stage companies who have not yet generated revenue or raised money and calculates the value by subtracting liabilities from assets.

Equity must then be allocated among the various classes of stock using one of three methods: the current value method (estimating the total equity value at that time), the probability-weighted expected return method (analyzing future values based upon various outcomes), and the option pricing method (derived from the price of the company’s common stock).

Valuation experts discourage the practice of discounting the latest preferred round share price to determine the value of common stock. This approach fails to account for the firm’s capital structure and the volatility of the firm’s value.

What is the process for a 409A valuation?

Once you have retained a qualified, independent valuation expert, the process usually involves brief interviews with management and a review of company financials and documents (executive summary, capitalization table, articles of incorporation, etc.). The valuation expert will use this information to conduct a formal valuation and issue a report stating the conclusions, often referred to as a valuation opinion report.

The Scalar experience is unique in that clients are included in every step of the process and Scalar performs a multi-tiered review process for each valuation to ensure the most accurate opinion report possible. This highly collaborative process keeps clients informed and also expedites the process to provide some of the industries fastest turnaround times while still maintaining an unwavering level of quality.

Who uses the valuation and for what purposes?

Board members and executives use the 409A valuation report to determine the appropriate strike price for stock options issued as compensation to employees. The reports are subject to review by audit firms for expense and tax reporting purposes.

If your company goes public, the SEC scrutinizes all stock option grants to determine whether or not the exercise price of each grant is defensible, often referring to the 409A valuations of independent appraisers. The valuation report may also be used in court if necessary.

In need of a 409A valuation?

If your company needs to demonstrate compliance with the regulations established under section 409A, Scalar can help. Scalar’s valuation specialists will work closely with your team to determine the fair market value of your company’s stock as of the grant date(s), taking into consideration the regulations and using acceptable valuation methodologies that meet the requirements under other sections of the IRC.

Scalar is committed to providing accurate, timely and unbiased opinions of value that will withstand scrutiny by auditors, attorneys, lenders, and regulatory agencies. Scalar’s focus on valuation means your valuation opinion report will be completed with the highest level of technical proficiency and maintain the highest valuation standards.

If you are in need of valuation services, you can request a complimentary consultation or call 385.831.1010.