Business valuation is the process of determining the value of a company. The value of a company can vary depending on the approaches and data used by the valuation expert. The emphasis put on each approach and the manner in which the data is interpreted by the valuation expert also influence the final valuation.

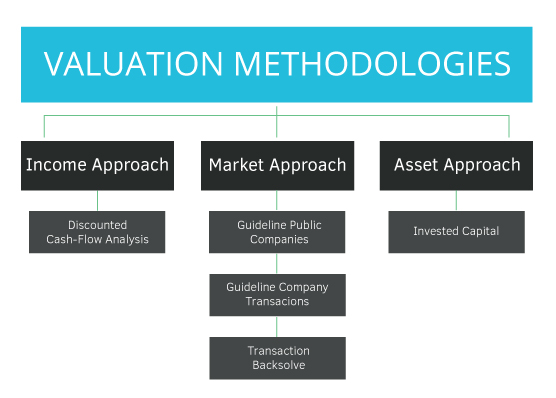

There are several approaches specialists can use to calculate value. Each approach has one or more methods that are primarily used to value a company. Valuation specialists may use one approach or a combination of them, depending on which one will generate the most accuracy based on your company’s unique situation.

The three main approaches are: market approach, income approach, and asset approach, and the following post will describe each approach and its methodologies in more detail.

Market Approach

This approach calculates the value of an asset by comparing the selling price of like items. In addition, the market approach can determine the worth of a business ownership interest, property, security, and intangible assets.

Since the market approach uses comparables to make valuations, it can trigger concerns if the sales and revenue figures are not accurate. To avoid inaccuracies, make sure the companies being compared offer similar services and use adequate multiples.

The market approach has three methods that are used to calculate value: guideline public companies, guideline company transactions, and transaction backsolve.

Guideline Public Companies

The guideline public companies method consists of a research and comparison process. Valuation experts search for publicly traded companies that are within the same industry and are similar to the target company, ideally ones that could be competitors and resemble the same size, age, and growth rate.

Information that is used to make a comparison can include equity valuation metrics and comparable market share. Once several companies have been identified, the valuation expert finds the average of their values or calculates their multiples to determine where the target company ranks in an industry.

Multiples are calculated by using a company’s revenue to determine the value of the company. Typically, the company’s worth is based on a multiple of the revenue, and that multiple depends on that company’s industry.

Although this is the most common method for valuing a private company, finding comparable companies can be difficult due to the small percentage of publicly traded companies. According to Investopedia, less than 1% of companies in the U.S. are publicly traded.

Guideline Company Transactions

The guideline company transactions methods is used when a company is being targeted in a mergers and acquisitions (M&A) deal—when another company is trying to acquire a company or merge with it.

This method is very similar to the guideline public companies method. The difference is that the multiples are applied to recent transactions. The people acquiring the company search for similar companies that have comparable transactions—arrangements made between buyers and sellers to exchange goods, services, or assets. The more recent the transactions are, and the more data available, the more accurate a valuation will be.

When using this method, professionals need to make sure there are public companies that can be used as a comparison because there is limited data available from private companies.

Transaction Backsolve

The transaction backsolve method is one of the most precise indicators of value and is used when a recent security transaction occurs. The transaction is usually a new financing round that has closed, or will close soon. Financing rounds show anticipations about a company in a given time, while considering how the firm finances its operations and growth. Understanding the financial round ultimately helps analyze an organization’s total equity value.

Typically, a company’s total equity is valued and then it goes through an allocation process to estimate the value of each equity asset. In the backsolve method, allocation of equity is applied backwards. Hence, the name “backsolve method.”

Income Approach

The income approach values a business by projecting how much revenue it will make in the future. This approach is sometimes used in order to demonstrate how appealing a business may be for an investment opportunity. The discounted cash-flow analysis is the primary method used in this approach.

Discounted Cash-flow (DCF) Analysis

The DCF analysis considers the time value of money—the future value of a specific amount of money that has been affected by its potential to earn more value. This method derives the value of an organization by projecting the annual cash flow and discounting it to determine the value today.

The DCF analysis is the most precise way of calculating value, but it is difficult to maintain accuracy due to the required projections. The estimate value determined by a DCF is based on predictions that rely on assumptions. Thus, the projections become more complicated as they extend into the future.

A DCF valuation is suitable for established companies that are highly stable because their cash flows are more predictable.

Asset Approach

The asset approach uses the value of assets to estimate how much money would be needed to recreate a company. The approach concentrates on either the net value or fair-market value of the assets.

The asset approach is the best approach when a company is losing business or is no longer operating. Sometimes business owners use this approach when they would like to hold on to investments or real estate. There can be debate as to what assets should be included in the valuation and whether their value has been measured correctly. Some of those assets may be intangible, such as services, making their value difficult to measure.

Invested Capital

The most common method of this approach is invested capital. The invested capital method is based off the monetary value of the invested capital or the liquidated value of assets. Examples of assets can include: inventory, equipment owned by the company, and real estate. Valuation professionals can help determine the value of a company by considering the replacement cost for these assets.

Additionally, the equipment currently owned by the company is necessary to run the business, making the company worth at least the cost of its assets. This method is executed by creating a balance sheet that tabulates the value of the assets, liabilities, and capital of an organization in a report.

When a business is not performing as expected, the value of all the liabilities is subtracted from the value of the assets. When a company is being liquidated, the net cash is calculated by the assets sold and the liabilities paid off.

Trying to figure out how much your business is worth?

Crunching the numbers to calculate the value of a company can take some time. Organizations that are valued internally run a higher risk of being audited by the IRS, as opposed to those valued by an independent firm. Experienced and certified experts understand which valuation methods to apply in order to produce the most accurate valuation for a company.

Scalar’s team of highly-skilled professionals has experience performing valuations for thousands of businesses ranging from start-ups to established companies. We have assisted a variety of clients from all industries including: software, tech, fashion, healthcare, education, automotive, financial, and more.

Our team of valuation consultants are here to help with any stage of valuation consulting services and enterprise valuation services. If you are in need of valuation services, you can request a complimentary consultation or call us at 385.831.1010.