The PE Professional’s Guide to Purchase Price Allocations (PPAs)

Introduction

Purchase Price Allocations (PPAs) are one of the most common valuation exercises for private equity portfolio companies. These valuations, also called ASC 805 valuations, are required when a private equity firm invests in a new platform or makes an add-on acquisition. The goal of a PPA is to measure or update the fair value of assets, liabilities and equity following a transaction.

Despite their prevalence, PPAs often present challenges for deal teams and CFOs. The process can be stressful, information-intensive, and time-consuming, sometimes leading to missed audit deadlines. This guide will explain the PPA process, provide realistic examples, and share practical insights to ensure your next PPA is as smooth as possible.

What is purchase price allocation?

Updating financial statements to record a merger or acquisition is a highly technical process, and its steps are outlined in the Accounting Standards Codification (ASC) 805. This financial reporting requirement is known as the acquisition method of accounting.

The acquisition method has four steps (ASC 805-10-05-4):

1. Identifying the acquirer

2. Determining the acquisition date

3. Recognizing and measuring the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree

4. Recognizing and measuring goodwill or a gain from a bargain purchase

Steps three and four require assets, liabilities, and goodwill or bargain purchase gains to be recognized and measured at Fair Value (FV) as of the acquisition date. This applies to all assets and liabilities, including those already on the balance sheet (accounts receivable, inventory, property, plant and equipment, accounts payable) and newly recognized intangible assets and liabilities (such as customer relationships, trademarks, goodwill, and contingent consideration). These Fair Value measurements are accomplished by purchase price allocation.

What is the PPA process?

The formula for measuring goodwill is useful for understanding the PPA process. Below is a simplified version of the goodwill formula that is applicable to the vast majority of private equity platform and add-on deals:

| Fair Value of Consideration Transferred (the purchase price) | (A) |

| – Fair Value of Net Assets Acquired | (B) |

| = Goodwill | A – B = (C) |

Let’s consider the different valuations that may be required as key inputs for this calculation.

(A) Valuing the Consideration Transferred

The first step in a purchase price allocation is to measure the Fair Value of the purchase price, or “consideration transferred” as it is known in the accounting literature. The consideration transferred can include cash, debt, rolled equity, and contingent consideration (earnouts). The Fair Value of the consideration transferred can vary from the negotiated amounts seen in a Sources & Uses statement or Purchase Agreement.

As an example, private equity deals frequently involve sellers rolling equity. The fund’s equity may be in a different class than the rolled equity, for example preferred stock vs. common stock. These different equity classes will often be treated as if they have the same face value, e.g. $1 per share. But oftentimes the preferred stock will have economic and non-economic terms that make it more valuable than common stock, such as a liquidation preference, accruing dividends, and voting rights. Accounting standards mandate that such differences be measured when calculating the purchase price, and this results in a lower Fair Value for the rolled equity.

Tip: Seeing rolled equity with a lower Fair Value than its negotiated value is sometimes a shock for deal teams and portfolio company management. It’s important to remember that purchase price allocation is primarily an accounting exercise. It does not change the cap table or the legal or tax status of either the fund’s or seller’s equity.

Earnouts, or “contingent consideration,” also must be measured at Fair Value. The Fair Value of an earnout will be lower than its total potential payout. How much lower depends on complex valuation analysis that takes into consideration the earnout target (an increase in revenue or EBITDA above a threshold, for example), the company’s forecasted financial performance, measurement timing (one year vs multi-year), time value of money, and other factors.

The first step is completed when all elements of the purchase price are measured at Fair Value. For all-cash deals, this is straightforward. But rolled equity and earnouts add to the valuation process.

Valuations are needed for earnouts and rolled equity in a different class than the PE fund (common units vs preferred units).

(B) Valuing the Net Assets Acquired

The second step in a purchase price allocation is to measure the Fair Value of the net assets acquired as of the acquisition date. This step assesses all the assets and liabilities already on the target’s balance sheet and includes the recognition of new identifiable intangible assets such as customer contracts, trademarks, developed technology, operating licenses, etc.

Several line items, including cash, accounts receivable, accounts payable, and accrued liabilities, are easily adjusted to Fair Value and do not require the help of a valuation specialist. Other line items require the use of an appraiser experienced in Fair Value measurements. In our experience, the following are the most common valuation needs for targets of private equity funds:

Inventory. Manufacturers and wholesalers holding significant inventories can expect a Fair Value adjustment. The net impact is often a “step up” in the value of inventory that increases cost of goods sold (COGS) and decreases gross margin. CFOs are advised to discuss materiality with their auditor and valuation specialist. However, the following factors typically indicate that an inventory valuation is needed: inventory represents a meaningful percentage of the total purchase price (5% or more); finished goods are sold at a high gross margin; work-in-process has a low cost-to-complete; and inventory can be disposed of quickly and at a low cost.

Fixed assets. Businesses with significant fixed assets (machinery, fleets, other property and equipment) may need a Fair Value measurement. The book value of fixed assets is often lower than Fair Value due to aggressive depreciation. Appraisers with unique credentials (sometimes called machinery & equipment specialists or personal property appraisers) are needed for these types of assets.

Intangible assets. Identifiable intangible assets are the most significant valuation requirement of purchase price allocations. The accounting standards recognize dozens of different intangible assets across five key categories: marketing, customer, artistic, contract, and technology-related intangible assets. In private equity acquisitions, several types of intangible assets are commonly valued, including customer relationships, trademarks, developed technology (which encompasses software and proprietary processes), assembled workforce, and non-compete agreements. Other intangible assets that may be valued depend on the target and its industry, but can include operating licenses, production backlog, internet domains, service contracts, and more. The specific intangible assets recognized in a PPA will depend on the nature of the target company and the judgment of company management and their valuation specialist.

Tip: PE-backed companies can save time and budget with the Private Company Council (PCC) accounting alternative for intangible assets. This accounting election, which still follows US GAAP while meeting a lower standard than publicly traded companies, reduces intangible asset valuation scope. Under the election, non-contractual customer relationships and non-compete agreements are not valued separately and are instead included in goodwill. In our experience, 80% of PE-backed portfolio companies make this election, and it is advised until the next liquidity event is likely to involve public markets.

PE portfolio companies should consider electing the PCC accounting alternative for intangible assets and goodwill to save on valuation fees.

(C) Goodwill

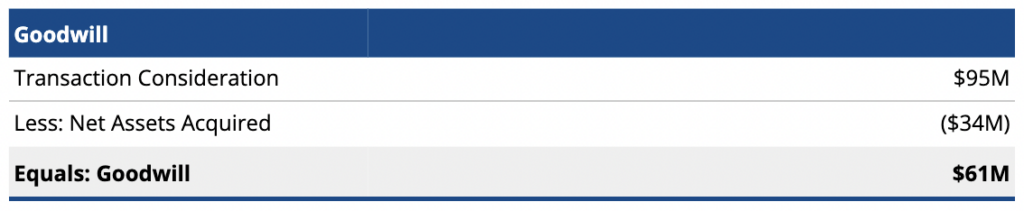

The final step in a purchase price allocation is to subtract the Fair Value of net assets acquired from the Fair Value of the consideration transferred to calculate goodwill. This last step is usually straightforward, but appraisers and auditors must complete several QA checks to ensure the resulting goodwill amount is reasonable. A key qualitative check is to simply ask if the valuation conclusions agree with the rationale behind the acquisition. For example, if a target was acquired because it has developed interesting proprietary software, is software the most valuable intangible asset? Is the software more valuable than the trademark? A key quantitative check is to compare the acquisition’s forecasted internal rate of return (IRR) with the company’s weighted average cost of capital (WACC) and weighted average return on assets (WARA). These checks are often key topics of discussion between auditors, company management, and appraisers during audit review.

PPA Case Study

The following is a typical PPA and opening balance sheet for a private equity fund’s acquisition of a new platform in the enterprise software industry.

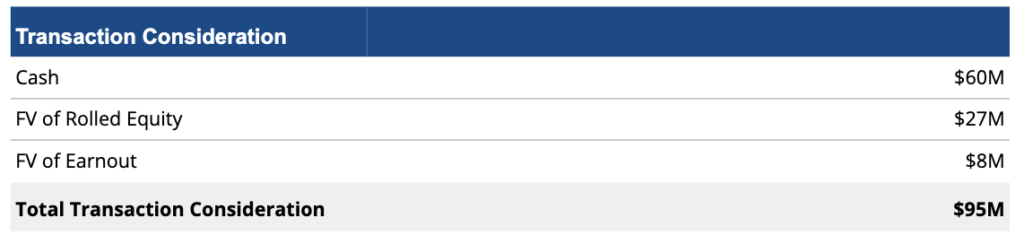

Purchase Price: The total purchase price has a face value of $100 million with $60 million in cash, $30 million in rolled equity, and a $10 million earnout based on hitting revenue targets over the next three years.

Valuing the Consideration Transferred. The seller’s rolled equity is in common units while the PE fund is in a preferred unit. The preferred unit has a 1x liquidation preference before common participates. This results in a slight Fair Value adjustment to the rolled equity, which is recognized at 90% of its face value, or $27 million ($30 million * 90% = $27 million).

The earnout is also measured for Fair Value, and based on its terms and the company’s forecasted revenue, is recognized at 80% of its face value, or $8 million ($10 million * 80% = $8 million).

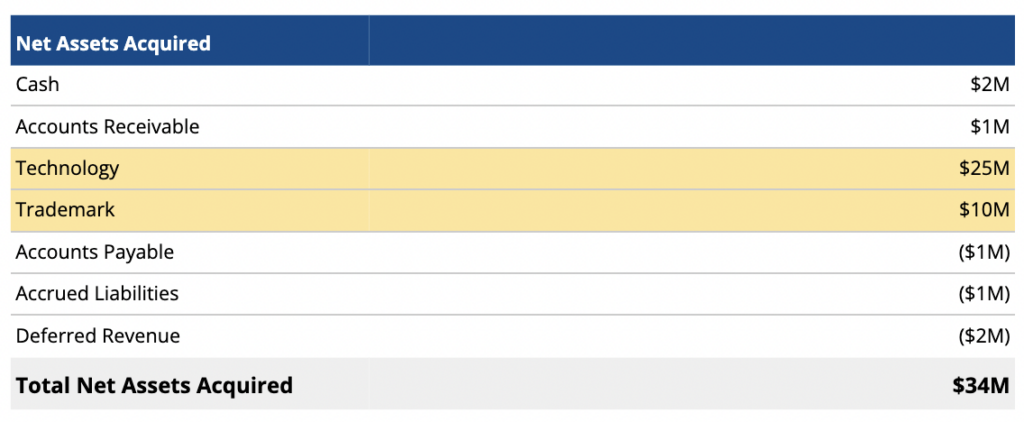

Valuing the Net Assets Acquired. The company’s balance sheet is primarily made up of working capital, and book value approximates Fair Value. The company elects the PCC accounting alternative, and two new intangible assets are recognized: technology and trademark. The technology is valued at $25 million and the trademark is valued at $10 million.

Goodwill. The calculation of goodwill is as follows:

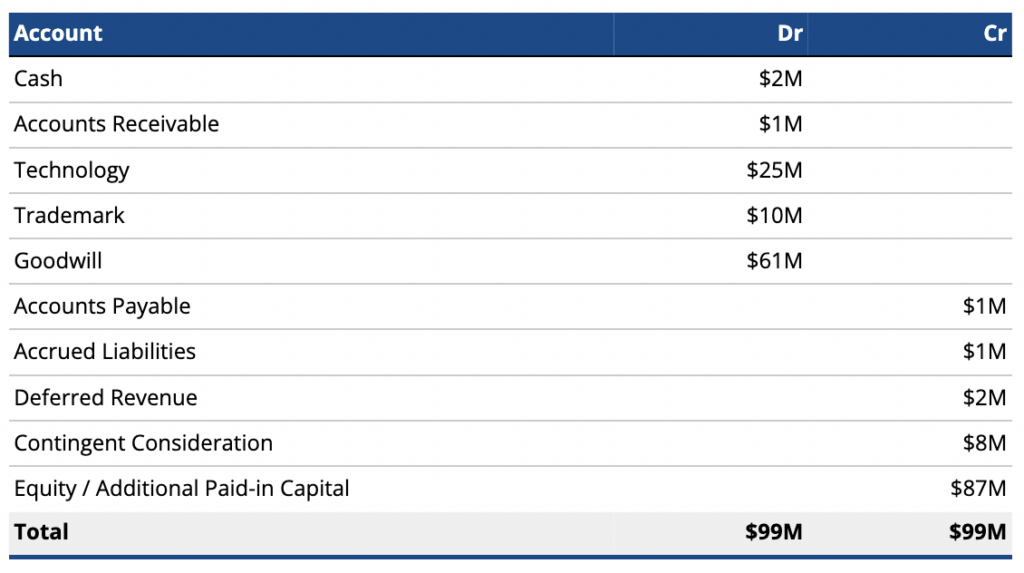

Opening Balance Sheet Journal Entries. The opening balance sheet journal entries are as follows:

Note that this is a simplified example of the purchase accounting journal entries under ASC 805. The exact entries vary based on the legal and economic structure of the transaction, and accounting elections made (such as pushdown accounting). Technical accounting advisors often work alongside valuation specialists to assist with business combination reporting and disclosure requirements.

Why do PPAs matter?

For the private equity-backed company, PPAs matter for two reasons. First, they are required to comply with GAAP (or IFRS) financial reporting, and frequently cause audit issues, CFO stress, and missed deadlines when ignored. Platforms are encouraged to engage a valuation provider as soon as possible following the deal when data and key information requests are still fresh. Second, they can have meaningful impacts on the post-acquisition financial statements. Intangible assets and goodwill are non-controversial as the amortization is a non-cash expense with no impact on EBITDA. Other Fair Value measurements are more sensitive. As an example, an increase in inventory value lowers gross margin going forward. For deals with an earnout tied to gross margin or EBITDA, this accounting exercise can have significant real-world implications.

When are PPAs needed?

PPAs are needed for all new platform investments and most add-on acquisitions. Add-ons of de minimis size, with no identifiable intangible assets besides non-contractual customer relationships, and funded exclusively via cash may be excludable from scope.

Platforms that make several relatively large acquisitions can expect a purchase price allocation for each one. Extremely acquisitive platforms with numerous relatively small deals, such as healthcare and professional services rollups, may not need a PPA for each one, or may be able to work with a valuation specialist to streamline the valuation process.

How are PPAs scoped and priced?

Valuation specialists scope purchase price allocations by gathering information on the transaction and the acquired company. Because thorough and effective scoping can avoid audit issues later, it’s recommended that a member of the deal team or a CFO with knowledge of the transaction have a 15 to 30 minute call with the valuation specialist. The specialist will ask about the sources of proceeds (with special attention to rolled equity and earnouts), the nature of the business (including its revenue model, relationship with customers, and operations), and the company’s balance sheet. The specialist will also ask about certain material contracts and arrangements, such as non-compete agreements for the sellers, the company’s leases, and other significant liabilities.

PPAs are priced based on the complexity and number of items in valuation scope. On the low end, all-cash deals that only require a trademark valuation (as an example) may cost as low as $10,000. On the high end, deals with rolled equity, an earnout, and multiple tangible and intangible asset valuations may cost two to three times or more of that amount. Other factors that influence price include the deal size, quality of financials, information availability, turnaround time, and level of audit scrutiny.

Tip: Private equity deals that include equity compensation, such as profits interests or stock options, likely also require an ASC 718 valuation. ASC 718 valuations are performed to determine the amount of stock-based compensation expense reported on the income statement. ASC 718 valuations should be completed at the same time as the purchase price allocation. The most common equity incentive plans we see, where profits interests vest based on a multiple of invested capital (MOIC) or internal rate of return (IRR) hurdle, require an ASC 718 valuation.

PE deals also need an ASC 718 valuation for equity compensation

(profits interests or stock options) that vest based on MOIC or IRR hurdles

Scalar ASC 718 in Private Equity Guide forthcoming

What information will be requested?

While the exact information requests vary based on scope, most valuation providers will request some version of the following:

- Historical and projected income statement and balance sheet

- Last twelve months (LTM) income statement and balance sheet as of the closing date

- Operating expenses broken out between sales & marketing (S&M), research & development (R&D), and general & administrative (G&A)

- Fixed asset ledger including tax value and remaining useful life

- Projected capital expenditure (CAPEX) requirements and depreciation expense

- Employee information including position, salary, and benefits burden

- Customer account-level revenue data for the last three years

- Sample customer contracts

- Quality of earnings / financial due diligence reports

- Closing docs including purchase agreement, funds flow / sources & uses

- Confidential information memorandum (CIM) and/or investment committee (IC) deck

- Capitalization table

- Operating agreement or articles of incorporation

- Non-compete agreements

- Equity incentive plan and sample award agreement

What should I look for in a PPA provider?

Independent valuation firms, the Big 4, and middle-market accounting firms all provide purchase price allocations. For PE portfolio companies, these are the most important questions to consider when looking for a provider:

- Is the provider experienced in valuations specifically for private equity deals?

- Does the provider understand the acquired company’s industry and operations?

- Does the provider offer proactive suggestions for managing scope?

- Does the provider have bandwidth and will they be able to meet reporting deadlines?

- Is the provider able to meet all our valuation needs, including tangible and intangible assets, equity, and contingent liabilities, if applicable?

- Does the provider show an interest in working collaboratively with the fund, company management, and our auditor to ensure a smooth process?

- Did the provider offer a clear scope of work and fixed fee appropriate for our fact pattern?

When in doubt, senior investment professionals at the fund and auditors are often able to suggest different service providers. It’s often helpful to get several proposals to ensure competitive bids and get a feel for working with the valuation provider.

Talk to Scalar

Scalar’s valuation professionals have completed 30,000 valuations for more than 10,000 companies. The vast majority of our clients are backed by leading private equity and venture capital funds. And we’ve earned a net promoter score (NPS) of 95, double the industry average, by being the easiest valuation firm to work with.

Contact us for a consultation.

Samuel Scott, ASA

Principal, Private Equity Practice

469-352-4486